How can I buy at net price?

Why is it good to have an EU tax number?

If a company has an EU tax number, it can buy products from other EU countries for a net price (-27% Hungarian VAT) amount. Having an EU tax identification number offers multiple benefits for individuals and businesses engaging in operating across European Union member states. Eases Trade Within the EU. Having an EU tax number simplifies the process of trading goods and services within the European Union. Having an EU tax number can enhance the credibility of a business.

You can check your community tax number on the European Commission's website at europa.eu.

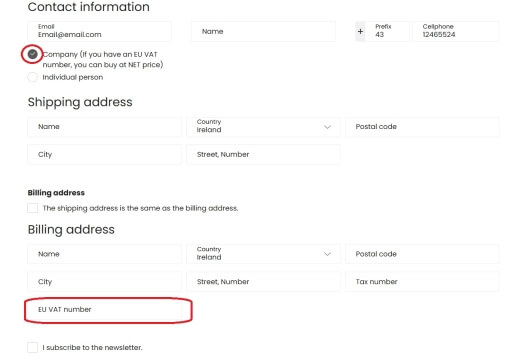

You can enter your EU VAT number during the checkout process under the billing details section. Please ensure that the VAT number is entered accurately, as our system automatically verifies its validity. In case the number is incorrect or missing, the system will be unable to apply VAT exemption, and a standard VAT-included invoice will be issued.

An EU VAT number typically consists of a two-letter country code followed by 8 to 12 digits. For example: HU12345678.

How can I get an EU tax number?

Do you want to get a VAT number in the EU Member State? Do you carry out transactions that are taxed abroad? If so, you must obtain a foreign VAT number in the country where taxable transactions are conducted. In order to submit an application for registration and get a VAT number, you can go directly to the official website of the administration authority of the relevant country or ask your accountant or lawyer.

Who should apply for a Community tax number?

If the taxable person wishes to establish a commercial relationship, it must apply for a Community tax number. Any business that is involved in trading goods or services across EU member states should apply for a Community tax number. This is essential for making intra-Community acquisitions or supplies, and to make the process of reclaiming VAT more streamlined. Businesses that sell goods online to customers in different EU member states are also required to have a VAT number. This applies whether you are selling through your own website or through an e-commerce platform. Even if you are a solo entrepreneur or freelancer offering services across EU borders, you will need a Community tax number for invoicing and tax compliance.